With the full effects of the coronavirus pandemic yet to be seen, early retirees and pre-retirees are worried about the effects of a recession on their portfolios. When you’re young, a down market only temporarily drops your funds (ideally). Realistically, there is a good chance that you will recover and grow with the help of time and compound interest.

However, if you’re about to retire or already retired, one of the worst things that can happen to an unprotected portfolio is entering a bear market right as you enter retirement. Sadly, this has happened to so many over the years. We need to take a look at recessions of the past to see what we can learn from those that have been unlucky enough to experience bad timing.

What can we learn from the recessions of the past? How exactly have they impacted retirement? And, most importantly, what can you do to protect yourself from a potentially catastrophic outcome?

RECESSIONS OF THE PAST

Research shows us that unlucky retirees with a poor sequence of returns were 31% more likely to outlive their money. They also had 11% lower retirement incomes. [1] Sequence of returns risk is often overlooked by retirees because the average person has an optimism bias – the belief that you are less likely to experience a negative event than someone else. The fact is, you are just as likely as anyone else to be hard hit by a recession at the wrong time.

TIMING IS EVERYTHING

Why is a recession at the start of retirement worse? When you haven’t yet retired, there is recovery time for your accounts after a down market hits. But if you’re withdrawing money at the same time a recession hits, you actually permanently reduce your ability to recover those losses. Compound interest has no opportunity to work its magic. [2]

RECESSIONS OF THE PAST

Research shows us that unlucky retirees with a poor sequence of returns were 31% more likely to outlive their money. They also had 11% lower retirement incomes. [1] Sequence of returns risk is often overlooked by retirees because the average person has an optimism bias – the belief that you are less likely to experience a negative event than someone else. The fact is, you are just as likely as anyone else to be hard hit by a recession at the wrong time.

TIMING IS EVERYTHING

Why is a recession at the start of retirement worse? When you haven’t yet retired, there is recovery time for your accounts after a down market hits. But if you’re withdrawing money at the same time a recession hits, you actually permanently reduce your ability to recover those losses. Compound interest has no opportunity to work its magic. [2]

WHAT IS COMPOUND INTEREST?

Compound interest is essentially interest earned on interest. Conversely, simple interest is simply the interest earned on the principal each year. Compound interest is the interest earned on the addition of the principal plus previously accumulated interest. Basically it is the result of reinvesting interest.

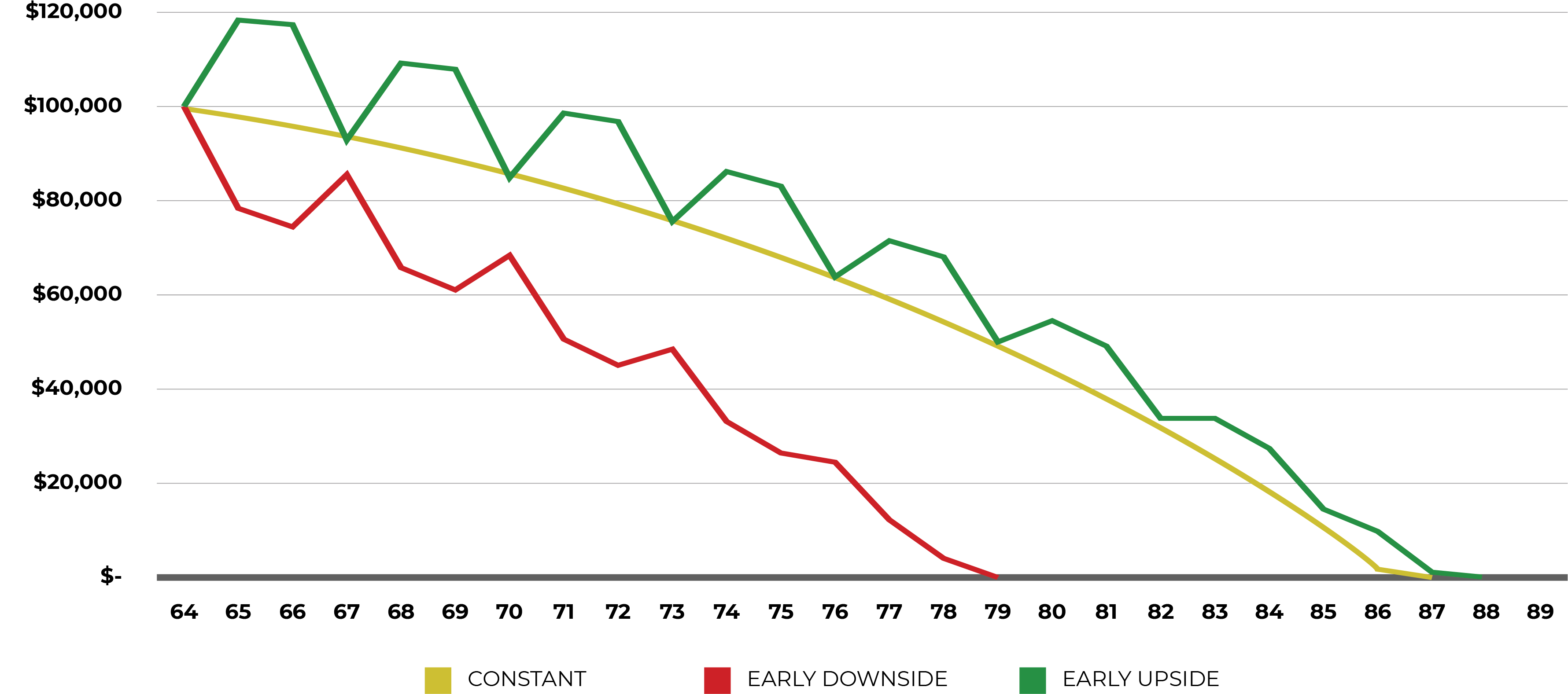

This is how early losses can recover. However, take a look at the following chart to see a real-life example of how an early loss can damage your retirement savings:

This graph assumes a starting portfolio of $100,000 with an annual withdrawal of $9,000. It shows that in the yellow line, a constant 7% rate of return allows the money to last to age 87. The green line shows an early gain of 27% with ups and downs of the market and this money lasts to age 88 or longer. Compare those two lines to the red line showing a portfolio that went through a single poor return (-13%) early on. That single poor year caused them to run out of money by age 79.

REAL LIFE EXAMPLE – 1973 VS 1974 RETIREE

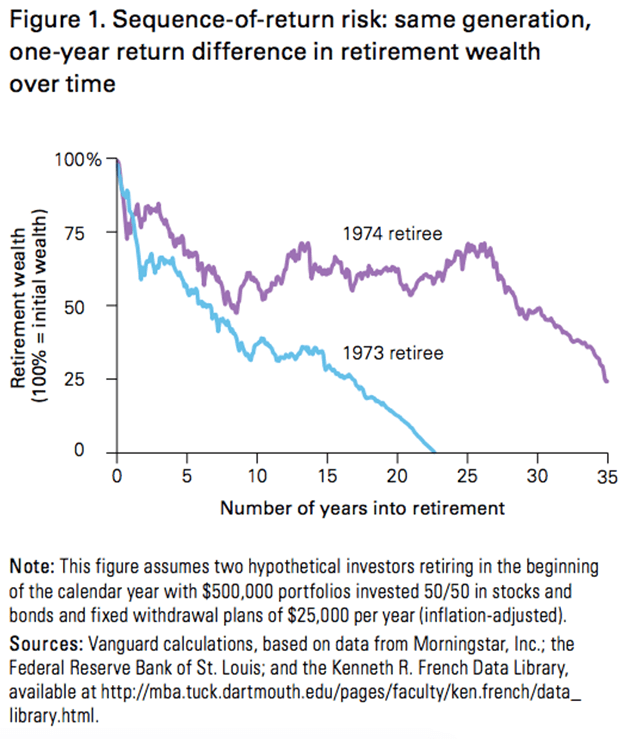

The following graph shows what a difference of one year can make on a retirement portfolio. Both of these investors started out with $500,000 and withdrew at a rate of $25,000 per year. Because of one severe bear market decline in 1973, that investor ended up running out of money 23 years into retirement. Just one year later, the 1974 investor retired and ended up maintaining a balance of $300,000 for most of their 35 years of retirement.

These two investors had almost identical situations, with 34 of 35 years of overlap in the market. The impact of one early recession on a portfolio cannot be overstated. Sometimes it is only by way of illustrations like this that can we really see the potentially devastating impact of an early down market on a portfolio.

Risk from Volatile Market

As long as a huge portion of your retirement savings is vulnerable to the risk of the market, you are vulnerable to running out of money while you’re alive. This is a huge risk that most people are trying desperately to avoid once they realize the potential for this. The main problem people make is when they trust the recovery potential of the market. Trusting this when you’re young is safe enough, but once you enter the withdrawal phase of retirement, you can see that the risk of running out of money only grows every year.

One strategy is to consider withdrawing at a constant rate rather than a rate adjusted for inflation (say, 4% rather than 4% adjusted for inflation). It also helps to be flexible with your spending. You can’t realistically expect constant spending to work out in a volatile portfolio. The trouble with this is that it may mean adjusting your standard of living, since you’d be taking less income in certain years. You may, understandably, not be willing to do this.

Risk from Volatile Market

As long as a huge portion of your retirement savings is vulnerable to the risk of the market, you are vulnerable to running out of money while you’re alive. This is a huge risk that most people are trying desperately to avoid once they realize the potential for this. The main problem people make is when they trust the recovery potential of the market. Trusting this when you’re young is safe enough, but once you enter the withdrawal phase of retirement, you can see that the risk of running out of money only grows every year.

One strategy is to consider withdrawing at a constant rate rather than a rate adjusted for inflation (say, 4% rather than 4% adjusted for inflation). It also helps to be flexible with your spending. You can’t realistically expect constant spending to work out in a volatile portfolio. The trouble with this is that it may mean adjusting your standard of living, since you’d be taking less income in certain years. You may, understandably, not be willing to do this.

De-Risk Your Portfolio

As Robert Powell, editor of Retirement Weekly, said “Sequence-of-returns risk is a function of volatility.” [4] There are multiple strategies to reduce this risk. The most obvious one being to own less stocks. Your risk profile increases the more stocks you own. Rather than having a large portion of your money invested in stocks, invest in less risky assets like bonds or fixed annuities.

Act Now or Lose Big-time

According to retirement researcher Wade Pfau, “what happens during the first 10 years of your retirement largely dictates whether you’ll outlive your money.”5 Withdraw too much too early, or withdraw during a bear market and it could have catastrophic impacts on you’re your retirement longevity. Or be invested too heavily in stocks during a volatile period, and risk losing a hopeless amount of money permanently.

The best course of action if you are in the early stages of retirement (or just about to retire), would be to schedule a risk assessment consultation. Many new clients come to us looking for a second opinion and another set of eyes to evaluate whether they are appropriately invested and safe for the future.

Others come to us looking for calculations and projections of retirement income, RMD reports, and tax-reduction analyses. Whatever your needs, Ronald Gelok & Associates can help. Book a call today to discover what services may be a good fit for you and your retirement goals.

Act Now or Lose Big-time

According to retirement researcher Wade Pfau, “what happens during the first 10 years of your retirement largely dictates whether you’ll outlive your money.”5 Withdraw too much too early, or withdraw during a bear market and it could have catastrophic impacts on you’re your retirement longevity. Or be invested too heavily in stocks during a volatile period, and risk losing a hopeless amount of money permanently.

The best course of action if you are in the early stages of retirement (or just about to retire), would be to schedule a risk assessment consultation. Many new clients come to us looking for a second opinion and another set of eyes to evaluate whether they are appropriately invested and safe for the future.

Others come to us looking for calculations and projections of retirement income, RMD reports, and tax-reduction analyses. Whatever your needs, Ronald Gelok & Associates can help. Book a call today to discover what services may be a good fit for you and your retirement goals.

WE CAN HELP.

If you’re curious how you could optimize your retirement or financial plan, let’s talk. You can select from any of these options:

- Free discovery call. Ask any question you want. We can help you find the answers.

- Second opinion service. Already have an advisor? We can help give you a second opinion about your retirement strategies.

- Retirement Income Roadmap. This customized roadmap spells out when and where all your retirement income will come from – and how long it will last!

- Income Tax Reduction Analysis. Our most popularly requested item. This specialized report projects by how much certain strategies will reduce your income taxes.

- Full appointment with one of our advisors. Ready to have an advisor with a passion for tax-reduction on your team? Book an appointment to get started.

SOURCES

- Vangaurd research – Retiring in a bear market. https://personal.vanguard.com/pdf/ISGSRBM.pdf

- https://www.hermoney.com/invest/retirement/retiring-into-a-bear-market-this-one-move-will-help-you-survive-it/

- https://www.youtube.com/watch?v=wf91rEGw88Q

- https://www.marketwatch.com/story/how-to-avoid-sequence-of-return-risk-2013-09-28

- https://www.forbes.com/sites/wadepfau/2019/11/26/the-retirement-researcher-manifesto-part-one/?sh=60d102b95bac